Different types of Businesses Budgets

Main budget for the business are :

- Master Budget

- Operating Budget

- Cash Flow Budget

- Financial Budget

- Static Budget

Budgets guide the management for businesses track so they can manage resources. ,Businesses use the variety of budgets for measuring its spending and develop effective strategies for maximization of assets and revenues.

Let us describe in details:

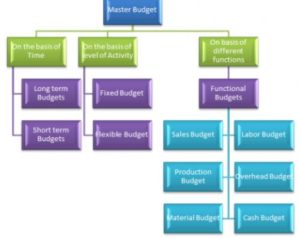

Master Budget

This budget is aggregate of business’s individual budgets and it is designed to present the complete picture of financial activity and health of the company. Master budget combines the factors like sales, the operating expenses, the assets, and the income streams for allowing companies for establishing goals and evaluate their overall performance, as well as that of the individual cost centers within the organization.

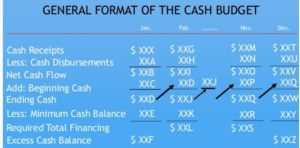

Cash Flow Budget

This budget show how and when cash comes in and flows out from the business within a specified time period. It is useful in helping the company for determining whether company is managing its cash wisely. It consider factors suchlike accounts payable and accounts receivable to assess whether a company has ample cash on hand to continue operating, extent to which it is using its cash productively, and likelihood of generating the cash in near future.

For Example:

The construction company, , might use its cash flow budget to determine whether it can start the new building project before getting the paid for the work it has in progress.

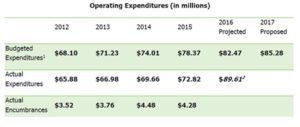

Operating Budget

An operating budget is a forecast and analysis of projected income and expenses over the course of a specified time period. To create an accurate picture, operating budgets must account for factors such as sales, production, labor costs, materials costs, overhead, manufacturing costs, and administrative expenses. Operating budgets are generally created on a weekly, monthly, or yearly basis. A manager might compare these reports month after month to see if a company is overspending on supplies.

Financial Budget

This budget presents the company’s strategy for managing its assets, cash flow, income, and expenses. The financial budget is used for establishing the picture of a company’s financial health and present a comprehensive overview of its spending relative to revenues from core operations.

Example:

software company, for instance, may use its financial budget for determining the value in the context of the public stock offering or merger.

Static Budget

The static budget is a fixed budget which remains unaltered regardless of the changes in factors such like sales volume / revenue.

Example:

Spare parts supply company may have a static budget in place each year for warehousing and storage, regardless of how much the inventory it moves in/out due to the increased or decreased sales.

For more help, you can email us to [email protected]

For assignment help/Homework help and tutoring help you can contact us at [email protected]

Views : 410877