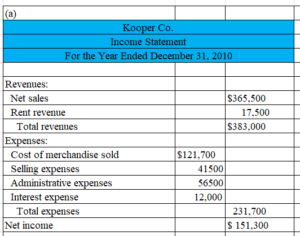

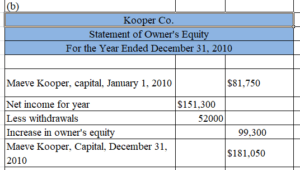

Prepare (a) a single-step income statement, (b) a statement of owner’s equity, and (c) a balance sheet in report form from the following data for Kooper Co., taken from the ledger after adjustment on December 31, 2010 the end of the fiscal year

| Accounts Payable | $ 97,200 |

| Accounts Receivable | 64,300 |

| Accumulated Depreciation – Office Equipment | 72,750 |

| Accumulated Depreciation – Store Equipment | 162,100 |

| Administrative Expenses | 56,500 |

| Maeve Kooper, Capital | 81,750 |

| Cash | 53,000 |

| Cost of Merchandise Sold | 121,700 |

| Maeve Kooper, Drawing | 52,000 |

| Interest Expense | 12,000 |

| Merchandise Inventory | 93,250 |

| Note Payable, Due 2012 | 154,000 |

| Office Equipment | 149,750 |

| Prepaid Insurance | 6,500 |

| Rent Revenue | 17,500 |

| Salaries Payable | 28,700 |

| Sales (net) | 365,500 |

| Selling Expenses | 41,500 |

| Store Equipment | 325,000 |

| Supplies | 4,000 |

Darshita Changed status to publish February 17, 2020

| Kooper Co. | |||

| Balance Sheet | |||

| December 31, 2010 | |||

| Assets | |||

| Current assets: | |||

| Cash | $53,000 | ||

| Accounts receivable | 64300 | ||

| Merchandise inventory | 93250 | ||

| Prepaid insurance | 6500 | ||

| Supplies | 4,000 | ||

| Total current assets | $221,050 | ||

| Property, plant, and equipment: | |||

| Store equipment | $325,000 | ||

| Less Accumulated depreciation | 162,100 | $162,900 | |

| Office equipment | $ 149,750 | ||

| Less Accumulated depreciation | 72,750 | 77,000 | |

| Total property, plant, and equipment | 239,900 | ||

| Total assets | $460,950 | ||

| Liabilities | |||

| Current liabilities: | |||

| Accounts payable | $97,200 | ||

| Salaries payable | 28,700 | ||

| Total current liabilities | $ 125,900 | ||

| Long-term liabilities: | |||

| Note payable (due 2012) | 154,000 | ||

| Total liabilities | $279,900 | ||

| Owner’s Equity | |||

| Maeve Kooper, Capital | 181,050 | ||

| Total liabilities and owner’s equity | $460,950 | ||

Darshita Changed status to publish February 17, 2020