There are 5 pictures I have added below. The first 2 are for case study #1. The following 3 pictures are for case study #2. I need help with case study # 1 and #2 please. All of the information needed is provided in the pictures. I repeat, I need help with case study #1 and case study #2. ALL SECTIONS NEED TO BE DONE OF BOTH CASE STUDIES!

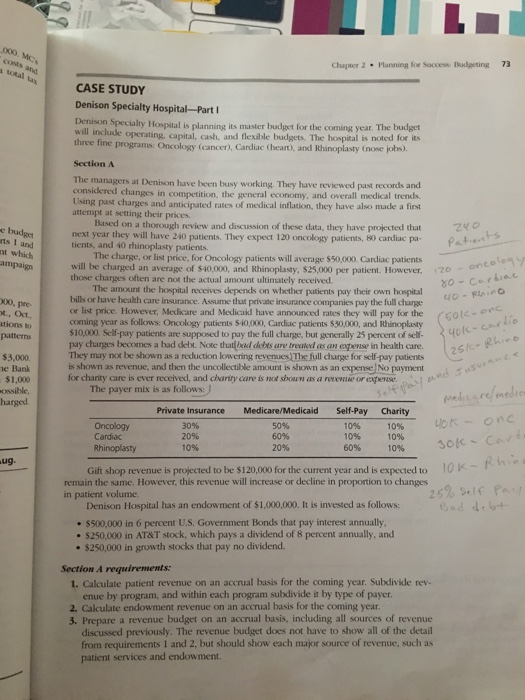

This is case study #1 Section A Problems #1, 2, and 3

This is case study #1 Section A Problems #1, 2, and 3

This is case study #1 Section A Problems #1, 2, and 3

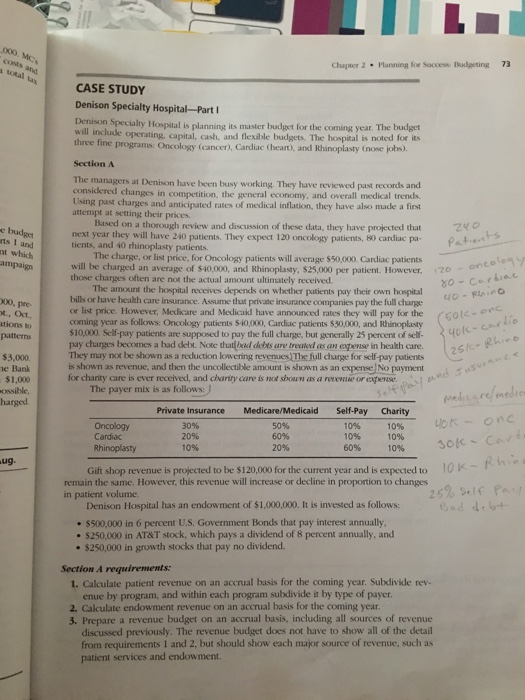

This is case study #1 Section A Problems #1, 2, and 3 This is case study #1 Section B Problems #1, 2, and 3

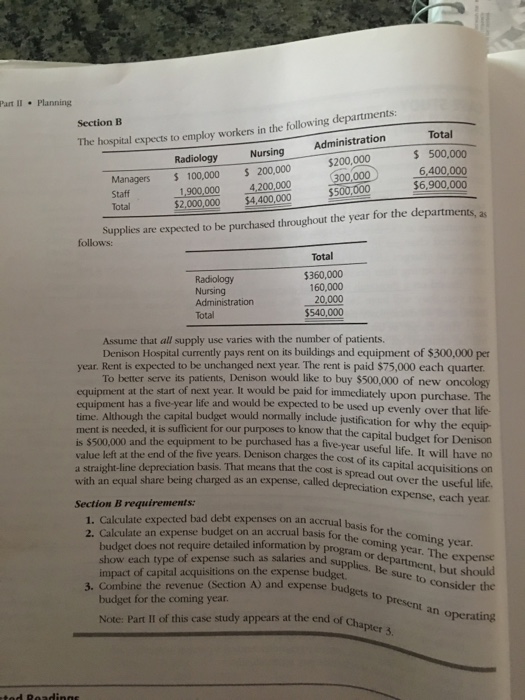

This is case study #1 Section B Problems #1, 2, and 3 This is case study # 2 Section C Problems #1 and #2

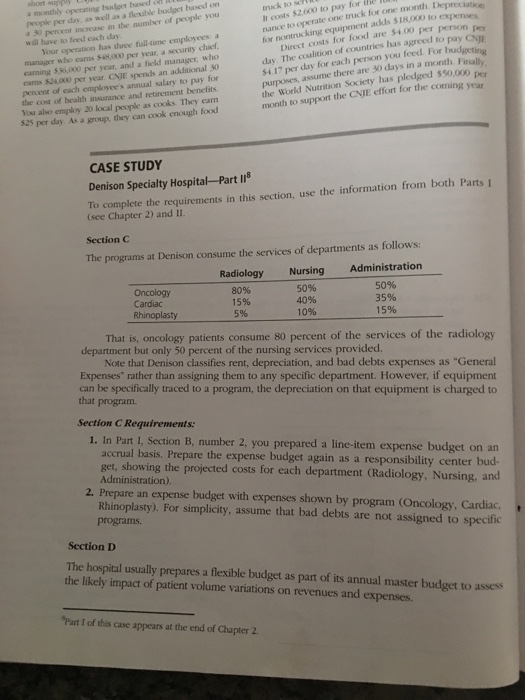

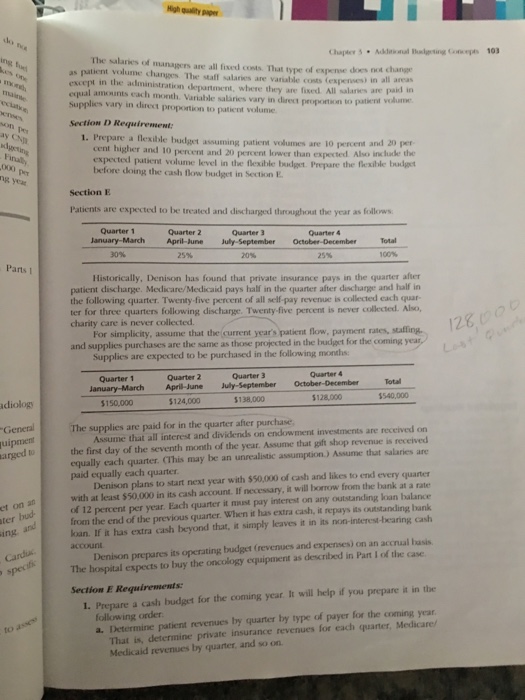

This is case study # 2 Section C Problems #1 and #2 This is case study #2 Section D Problem #1 AND Section E Problem #1 and #1a

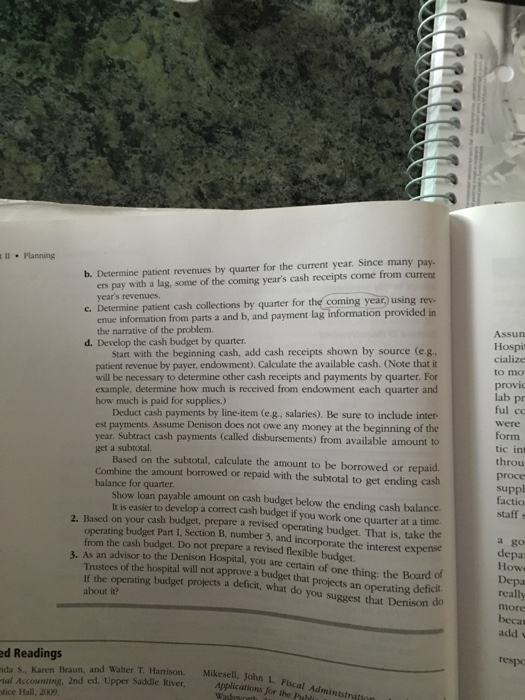

This is case study #2 Section D Problem #1 AND Section E Problem #1 and #1a This is case study #2

This is case study #2SOLUTION

Part I

Section A

1. Calculation of patient revenue

| Payer | Program | Volume by | Net | Net | |

| Mix | Volume | Payer | Price | Revenue | |

| (A) | (B) | (C = A B) | (D) | (E = C D) | |

| Oncology | |||||

| Private Insurance | 30% | 120 | 36 | $50,000 | $1,800,000 |

| Medicaid/Medicare | 50% | 120 | 60 | 40,000 | 2,400,000 |

| Self-Pay | 10% | 120 | 12 | 50,000 | 600,000 |

| Charity | 10% | 120 | 12 | 0 | 0 |

| Cardiac | |||||

| Private Insurance | 20% | 80 | 16 | 40,000 | 640,000 |

| Medicaid/Medicare | 60% | 80 | 48 | 30,000 | 1,440,000 |

| Self-Pay | 10% | 80 | 8 | 40,000 | 320,000 |

| Charity | 10% | 80 | 8 | 0 | 0 |

| Rhinoplasty | |||||

| Private Insurance | 10% | 40 | 4 | 25,000 | 100,000 |

| Medicaid/Medicare | 20% | 40 | 8 | 10,000 | 80,000 |

| Self-Pay | 60% | 40 | 24 | 25,000 | 600,000 |

| Charity | 10% | 40 | 4 | 0 | 0 |

| Total Patient Revenue | $7,980,000 | ||||

2. Endowment revenue

| Investment | Rate | Income | |

| U.S. Bond | $500,000 | 6% | $ 30,000 |

| AT&T Div | 250,000 | 8 % | $ 20,000 |

| Growth Stock | 250,000 | 0 | 0 |

| $ 1,000,000 | $50,000 |

3. Gift shop revenue: $120,000 for current year. Will remain the same next year. Assume that gift shop revenue varies with the number of patients in the hospital.

| Denison Specialty Hospital

Revenue Budget for Next Year |

Amount in $ |

| Net Patient Revenue | 7,980,000 |

| Gift Shop Revenue | 120,000 |

| Endowment Income | 50,000 |

| Total Budgeted Revenue | 8,150,000 |

Section B

1. Calculation of expected bad debts

| Bad Debt | |||||

| Revenue | Rate | Bad Debt | |||

| Oncology Self-Pay | (from above) | $600,000 | 25% | $150,000 | |

| Cardiac Self-Pay | (from above) | 320,000 | 25% | 80,000 | |

| Rhinoplasty Self-Pay | (from above) | 600,000 | 25% | 150,000 | |

| Budgeted Bad Debts | $380,000 | ||||

2. Consider annual impact of capital budget

$500,000 5-year life: Annual Expense $100,000

| Denison Specialty Hospital

Expense Budget for Next Year |

||||||||||||||||||||||||||||||||||||||||||

| Salaries | $6,900,000 | |||||||||||||||||||||||||||||||||||||||||

| Supplies | 540,000 | |||||||||||||||||||||||||||||||||||||||||

| Bad Debts | 380,000 | |||||||||||||||||||||||||||||||||||||||||

| Rent | 300,000 | |||||||||||||||||||||||||||||||||||||||||

| Depreciation Expense | 100,000 | |||||||||||||||||||||||||||||||||||||||||

| Total Budgeted Expense | $8,220,000 | |||||||||||||||||||||||||||||||||||||||||

3

|

||||||||||||||||||||||||||||||||||||||||||