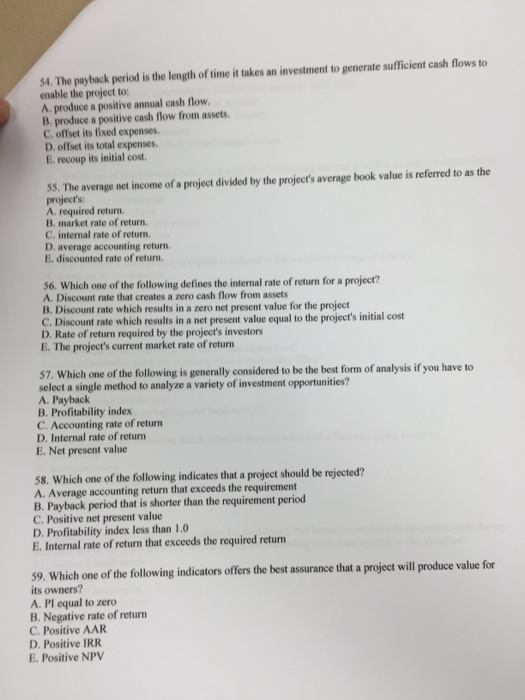

54 The payback period is the length of time it takes an investment to generate sufficient cash flows to enable the project to:

-recoup its initial cost.

Explanation : ganerally pauabk period means time required for the amount invested in an asset to be repaid by the net cash outflow generated by the asset. It is a simple way to evaluate the risk associated with a proposed project.

55A project’s average net income divided by its average book value is referred to as the project’s average:

Answer : Average accounting Return

Explaination :

Accounting return meas the average project earnings after taxes and depreciation, divided by the average book value of the investment during its life.So in this case project’s average net income divided by its average book value is referred to as the project’s average is Average accounting Return

56 Which one of the following defines the internal rate of return for a project?

Answer : Discount rate which results in a zero net present value for the project

57 Which one of the following is generally considered to be the best form of analysis if you have to select a single method to analyze a variety of investment opportunities?

Answer : Net Prasent value

58 which of the following indicates that a project should be rejected

Answer : D. profitability index less than 1.0

59 which one of the following indicators offers the best assurance that a project will produce value for it owners

Answer : Positive NPV

Explaination :

The main purpose of NPV is to help analysts to decide whether or not new projects are financially viable. Essentially, NPV measures the total amount of gain or loss a project will produce compared to the amount that could be earned simply by saving the money in a bank or investing it in some other opportunity that generates a return equal to the discount rate.