Answer : tomy should chose option 2 because it has PV =$ 290841.9

Working notes for the above answer is as under

Option 1

In option1 it is pretty simple to figure out.

Take the prize money times (1- 46%) to get the net cash received.

The 46% is your tax rate and this is the easy way to calculate the net amount received or the after tax amount received.

=506800 *(1-0.46)

=506800* (54)

=$ 273,672

Option 2

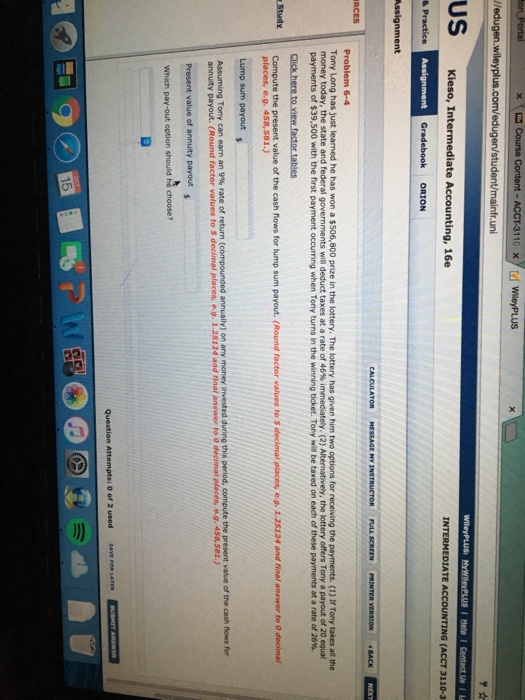

This is an annuity problem so you have to figure out what the total cash amount will be after the 20th payment.

Your known information is one payment received calculated earlier, 20 periods, and 8% interest compounded annually, so now you have the information needed to solve this problem.

Your individual net cash received each period will be calculated the same way as option one, just change the amount and the tax rate.

Your number of periods or number of payments received is 20, and your annual interest rate is 8%. Now you have the information you need to calculate the total amount of cash received.

Each payment recipt is

=39500 * (1-0.26)

=39500*0.74

=$ 29,230

First payment is received today so we need to calculate remaining 19 installment as follow

Pv = PMt( 1-(1+r)-n /r)

Pmt= periodic payment

r= interest rate

n = number of periods

Pv = 23230 (1 -(1+0.09)-19 /0.09)

=280713.20

Noe PV of option 2 is

=29230+261611.85

=$ 290841.9