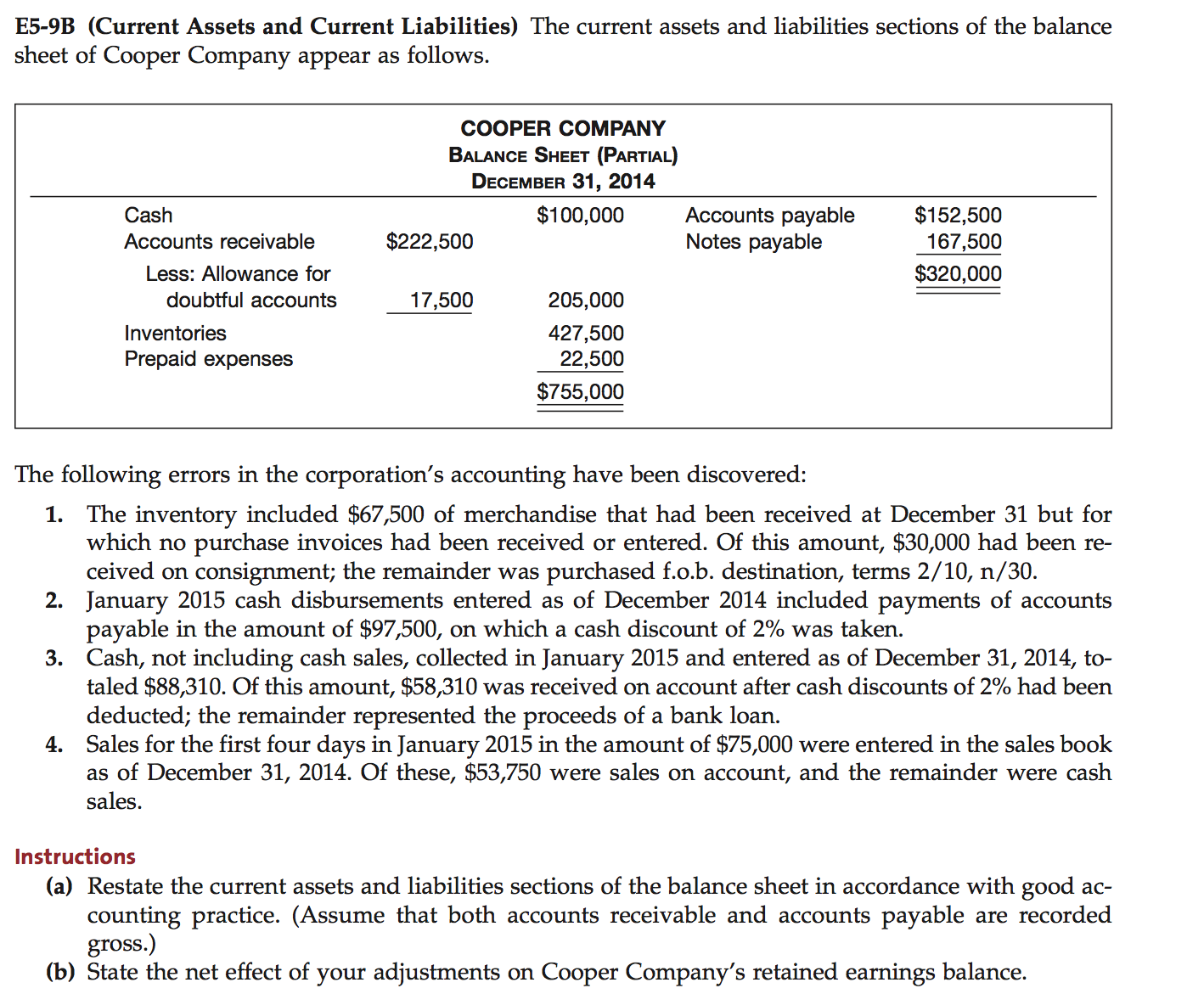

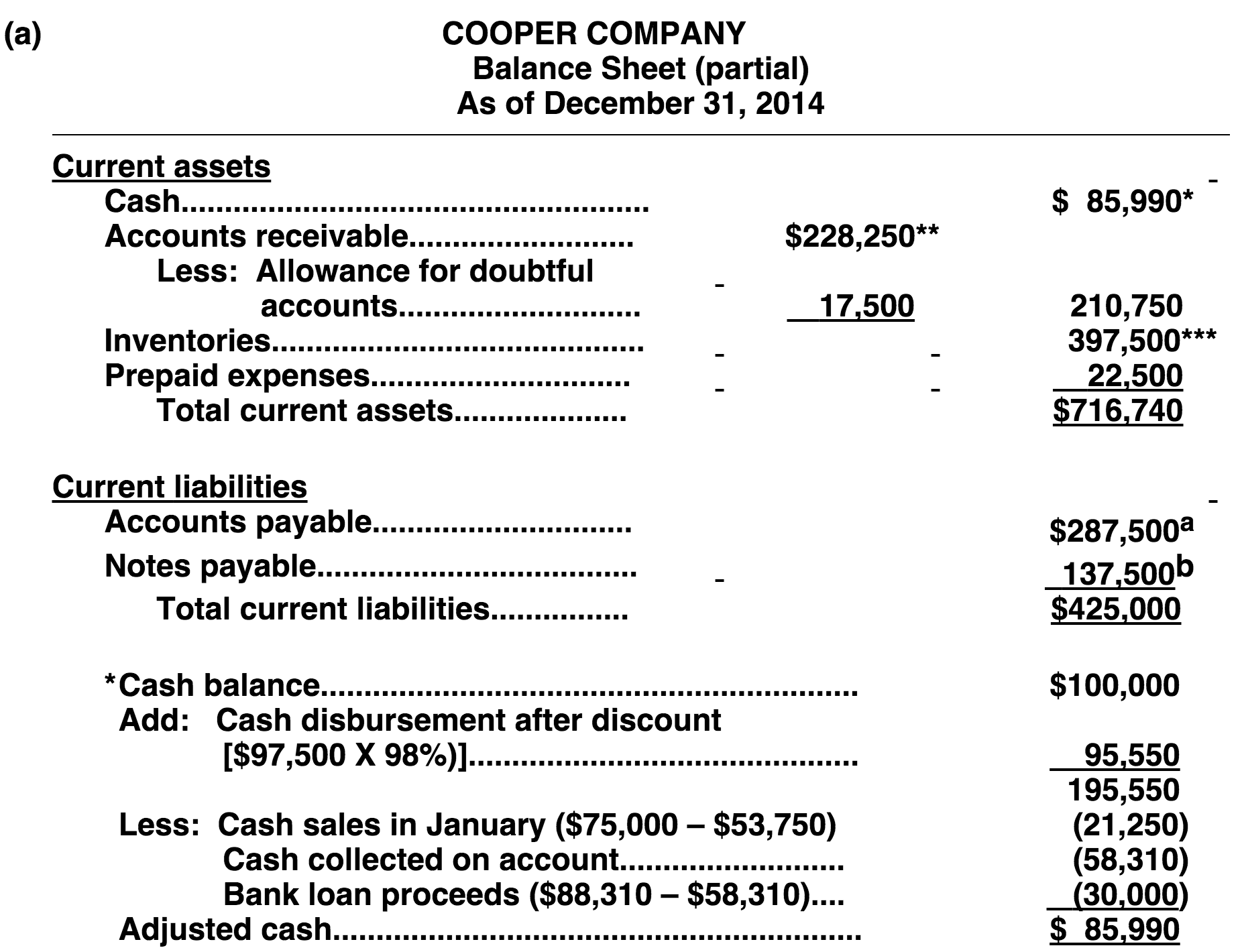

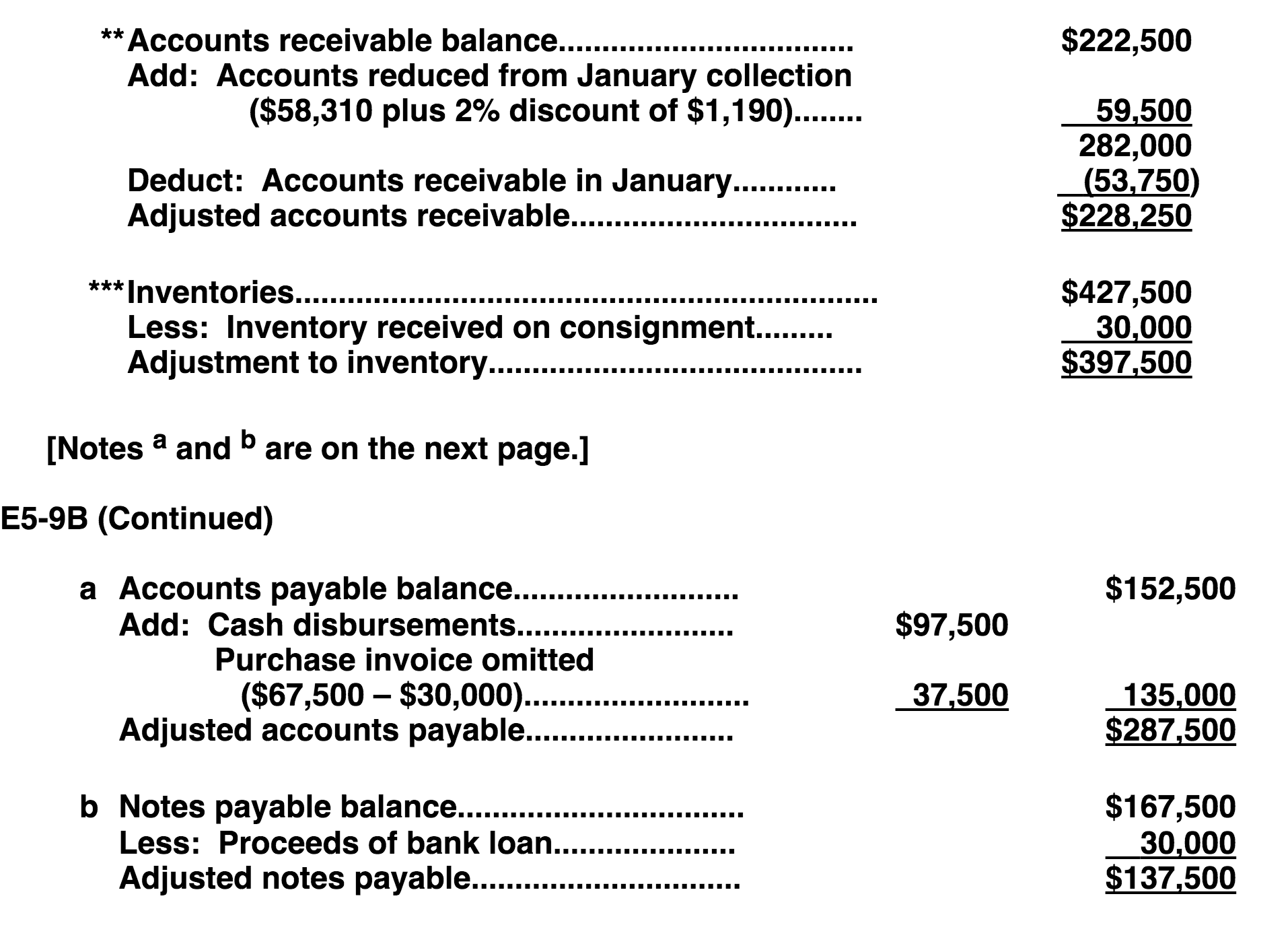

The inventory included $67,500 of merchandise that had been received at December 31 but for which no purchase invoices had been received or entered. Of this amount, $30,000 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30.

| Particular | Amoun t in $ |

| Inventory Balnce in the balancesheet | 427500 |

| Less : | |

| Inventory received on consignment bases | 30,000 |

| Net inventory | 397,500 |

For those inventory which we have received on consignment bases, we required the invoices but till 31, december we did not received invoice so we deduct 30,000 to make adjustment inventory

And it will aso affect the accounts payable because we wrongly recorded whole amont 67,500 to the in the purchase as well as accounts payable so we deduct 30,000 also from accounts payable . Its calculation shown in notes 2 Table

(2)

January 2015 cash disbursements entered as of December 2014 included payments of accountspayable in the amount of $97,500, on which a cash discount of 2% was taken.

This will affect wo account

(1) Cash

(2)Accounts Payable

cash disbursements entered as of December 2014 included payments of accountspayable in the amount of $97,500, on which a cash discount of 2% was taken so cash payment will added back to the cash as follow

| Particular | Amoun t in $ |

| Cash Balnce in the balancesheet | 100000 |

| Add: | |

| Cash disbursement after dicount 97500*98% |

95,500 |

| 195,500 |

We will also add the same amont to the accounts payable

| Particular | Amoun t in $ |

| Accounts payable Balnce in the balancesheet | 152500 |

| Add: | |

| Cash disbursement after dicount | 97,500 |

| Purchase invoice omitted | 30,000 |

| 280,000 |

(3)

Cash, not including cash sales, collected in January 2015 and entered as of December 31, 2014, totaled $88,310. Of this amount, $58,310 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan.

4. Sales for the first four days in January 2015 in the amount of $75,000 were entered in the sales book as of December 31, 2014. Of these, $53,750 were sales on account, and the remainder were cash sales.

First of all we will see the cash balalce adjustment

1

first four days in January 2015 in the amount of $75,000 were entered in the sales book as of December 31, 2014. Of these, $53,750 were sales on account, and the remainder were cash sales.

so form 75,000 ,$ 53750 is cresdit sale and remaining was cash sales

=75000-53750

=$ 21250

This $ 21250 we will deduct from cash

2

collected in January 2015 and entered as of December 31, 2014, totaled $88,310. Of this amount, $58,310 was received on account after cash discounts of 2%

So 58310 was not the figure of 2014 it is the figure of the year 2015

so we deuct 58310 form the cash and remaining

= 88310 -58310

= $ 30,000we considered as bank loan proceeds so we deduct form cash balance

And these 30,000’s other effects on notes payable because in the sum it was given that ; the remainder represented the proceeds of a bank loan.

so we will deduct from notes payable

| Particular | Amoun t in $ |

| Notes payable Balnce in the balancesheet | 167500 |

| Less : | |

| Proceeds from bank | 30,000 |

| 137,500 |

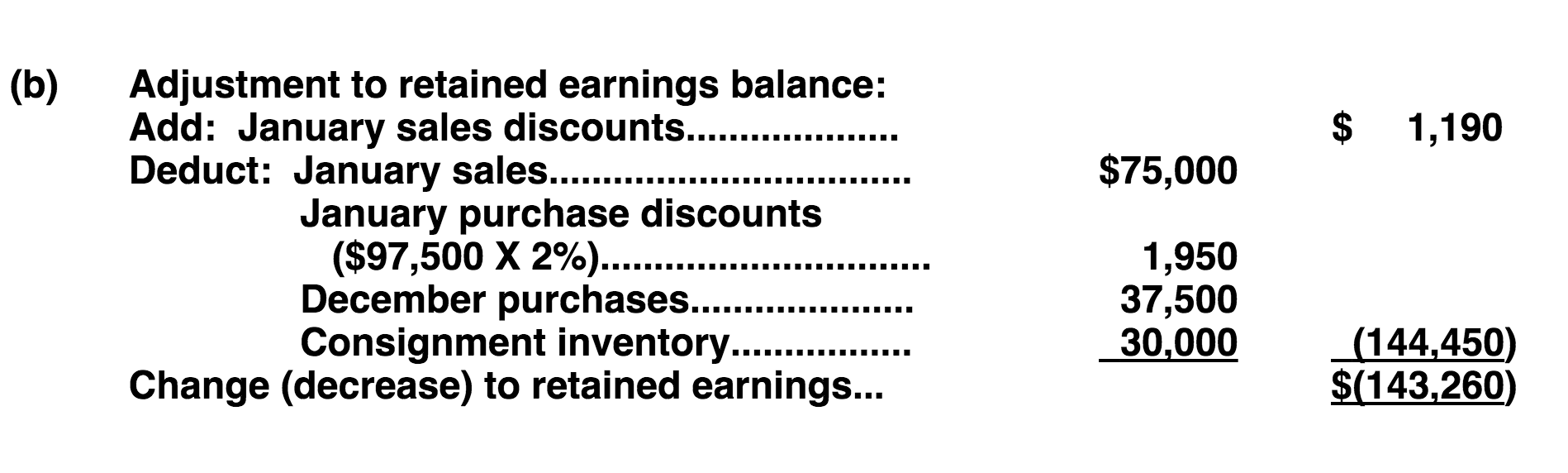

These all adustment affect the balalce of net income and it wiil affect the balance of retained earning, Sales discount will be added back and purchase discount will be deducted and net effect will given to retained earning