| Journal Entry Work Sheet -2016 | |||

| Number | Description | Debit $ | Credit $ |

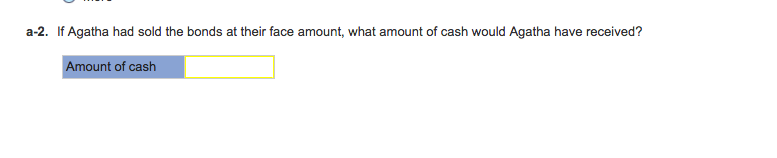

| Jan. 1 | Cash | 294000 | |

| Discount on Bonds Payable | 6000 | ||

| Bonds Payable | 300000 | ||

| (,Jan. 1 Issued $300,000 of 10-year, 6 percent bonds for $294,000. The annual cash payment for interest is due on December 31) |

|||

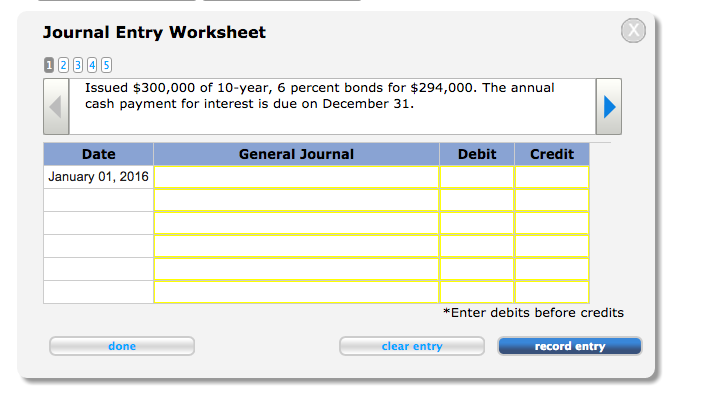

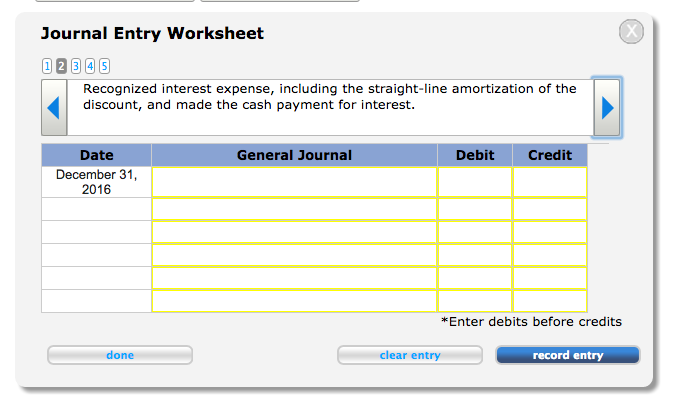

| Dec. 31 | Interest Expense | 18600 | |

| Cash | 18000 | ||

| Discount on Bonds Payable | 600 | ||

| (Dec. 31 Recognized interest expense, including the straight-line amortization of the discount, and made the cash payment for interest) |

|||

annual interest payment

= $300,000 x 0.06

= $9,000

The total discount of $6,000 is amortized over 10 years.

Since interest is paid once a year, the amount of discount amortized at the time of each interest payment = $6,000 /10

= $600