1

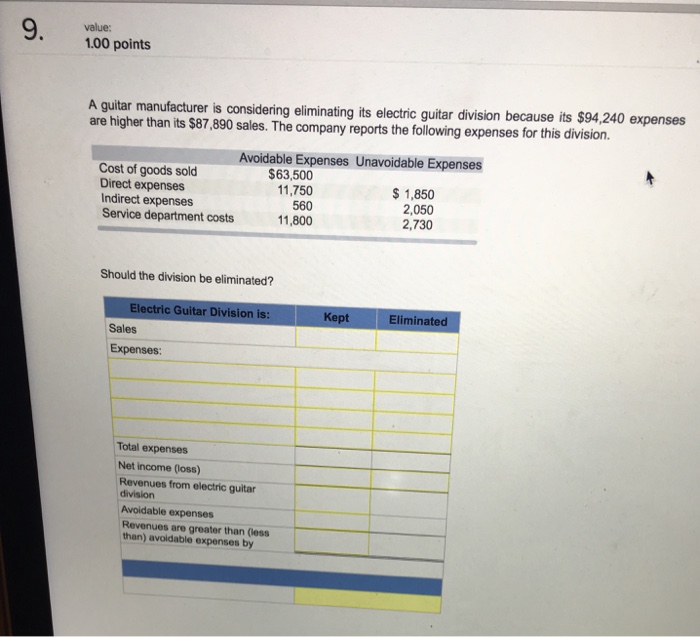

| Amount in $ | Amount in $ | |

| Sales | 87890 | |

| Less: | ||

| Avoidable Expenses | ||

| Cost of goods sold | 63500 | |

| Direct expenses | 11750 | |

| Indirect expenses | 560 | |

| Service department costs | 11800 | |

| Total Expenses | 87610 | |

| Income | 280 |

To make a decision whether the guitar division should be eliminated or not, unavoidable expenses should not be taken into account as these expenses will be incurred whether the division is eliminate or not.

So, these expenses are sunk cost for making the decision to eliminate the division or not.

From the above calculation we could see that that it can avoid $ 87610 expenses if it eliminates the electric guitar division. But, eliminating it will cause to lose $ 280 of income

So it should not eliminate the devision

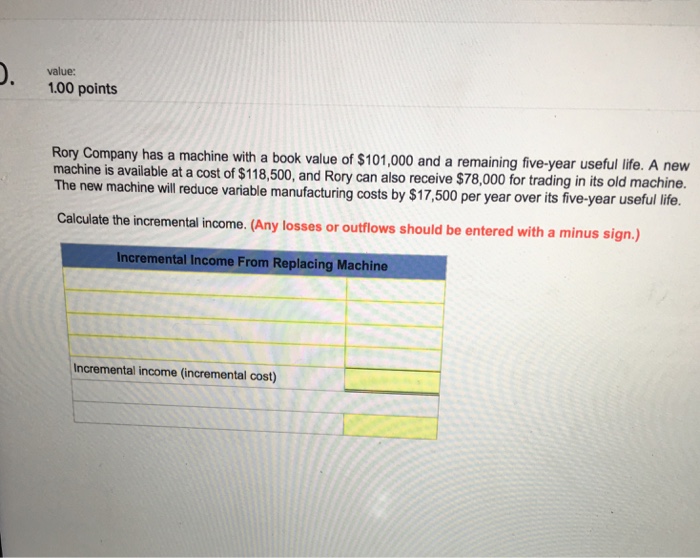

2

Rory Company

| Calculation of Incremental Income | ||||||

| Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Ne Machine Cost | 118500 | |||||

| Less: | ||||||

| Sale of Old Machine | -78000 | |||||

| Net Cashflow on Purchase of Machine | 40500 | |||||

| Saving in Variable cost | 17500 | 17500 | 17500 | 17500 | 17500 | |

| Incremental Inlow/ Out flow | 40500 | 17500 | 17500 | 17500 | 17500 | 17500 |