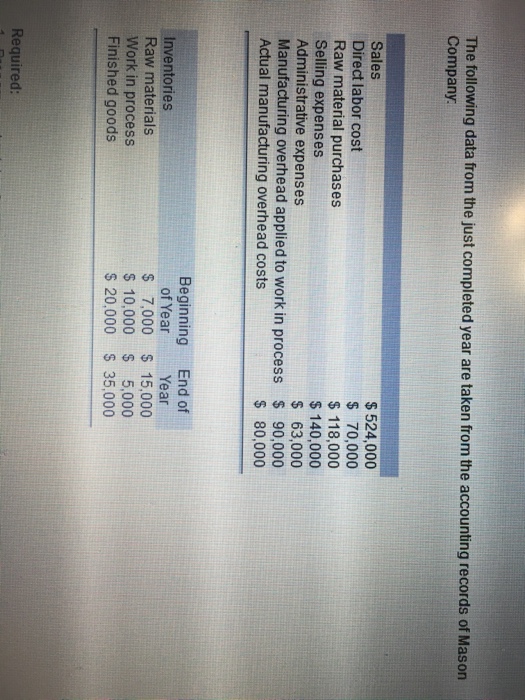

| Requirement 1 | ||

| Mason Company | ||

| Schedule of Cost of Goods Manufactured | ||

| Particular | Amount in $ | Amount in $ |

| Direct materials: | ||

| Beginning raw materials inventory | 7000 | |

| Add; Purchases of raw materials | 118000 | |

| Raw materials available for use | 125000 | |

| Deduct : Ending raw materials inventory | 15000 | |

| Raw materials used in production | 110000 | |

| Direct labor | 70000 | |

| Manufacturing overhead | 80000 | |

| Total manufacturing costs | 260000 | |

| Add : Beginning work in process inventory | 10000 | |

| 270000 | ||

| Deduct : Ending work in process inventory | 5000 | |

| Cost of goods manufactured | 265000 | |

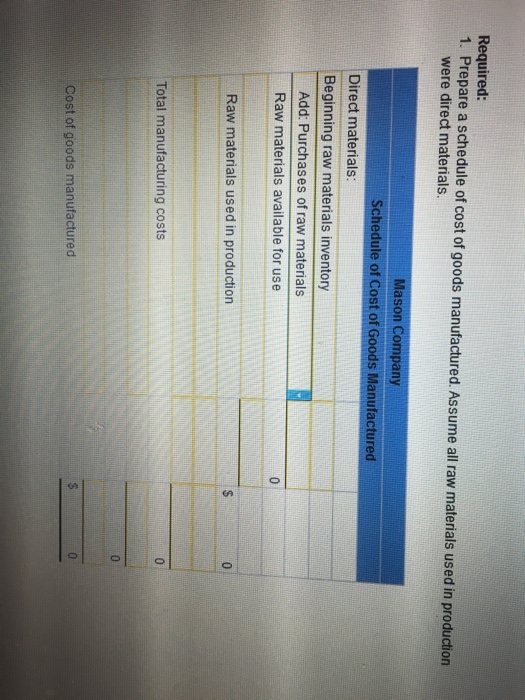

| Requirement 2: | |

| Prepare the cost of goods sold section of Mason Company’s income statement for the year. |

|

| Particular | Amount in $ |

| Beginning finished goods inventory | 20000 |

| Add: Cost of goods manufactured | 265000 |

| Goods available for sale | 285000 |

| Deduct: Ending finished goods inventory | 35000 |

| Cost of goods sold | 250000 |

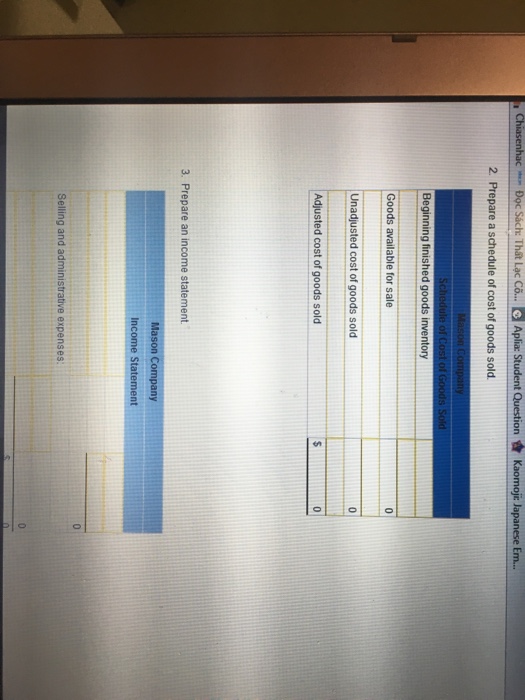

| Requirement 3: | |

| Income statement | |

| Particular | Amount in $ |

| Sales | 524000 |

| Less: | |

| Cost of Goods sold | 250000 |

| Gross margin | 274000 |

| Less: | |

| Selling Expenses | 140000 |

| Administrative Expenses | 63000 |

| Net Income | 71000 |