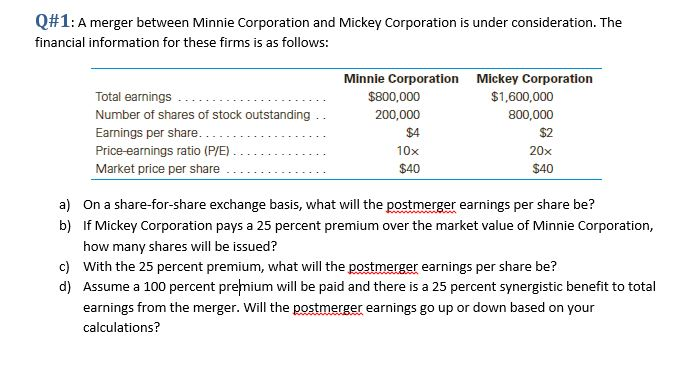

a.

Total earnings Minnie ($800,000) + Mickey ($1,600,000) =$2,400,000

Shares outstanding in surviving company:

The Mickey Corp. Old (800,000) + New (200,000) = 1,000,000

New Earning Per Share = Net Income / Share Outstanding

= $ 240,000 /1,000,000

=$ 2.40

B

| market price of Minnie | 40 |

| (25% premium) | 1.25 |

| (40 *1.25) | 50 |

| exchange value | 50 |

| shares | 200000 |

| total price | 10,000,000 |

Share issued = Total Price / Market Price

= $ 10,000,000 / 40

=250,000 ( Mickey)

Also, 1.25 × 200,000 Minnie shares = 250,000 Mickey shares. This shortcut approach may also be used because the shares have an equal price before the merger.

c

Total earnings Minnie ($800,000) + Mickey ($1,600,000) =$ 2400,000

Shares outstanding in surviving company:

The Mickey Corp. Old (800,000) + New (250,000)

= 1,050,000

New Earning Per Share = Net Income / Share Outstanding

= $ 240,000 /1,050,000

=$ 2.29

D

| market price of Minnie | 40 |

| (25% premium) | 2 |

| (40 *1.25) | 80 |

| exchange value | 80 |

| shares | 200000 |

| total price | 16,000,000 |

Total earnings: $2,400,000 × 1.25 =$ 300000

Shares outstanding in surviving company:

The Mickey Corp. Old (800,000) + New (400,000) = 1,200,000

New Earning Per Share = Net Income / Share Outstanding

= $ 300,000 /1,200,000

=$ 2.50