In tis sum we have been provided with the information that

An asset costs $840,000

depreciated in a straight-line manner over its three-year life

. It will have no salvage value.

The lessor can borrow at 5.8 percent

the lessee can borrow at 8.8 percent.

The corporate tax rate is 34 percent for both companies

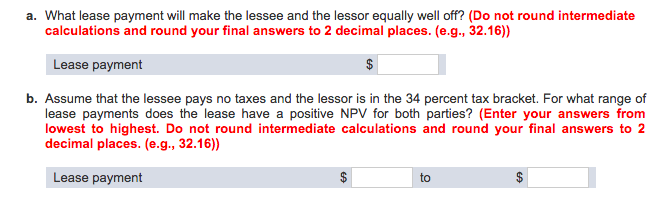

(a)

Taxes are paid at the end of the year . Depriciation will reduce incometax to lessor by $ 9520

per year

| Year0 | Year 1 | Year 2 | Year 3 | |

| Purchase | $ 84,000 | |||

| Depreciation | $ 28,000 | $ 28,000 | $ 28,000 | |

| Tax percentage | 34% | 34% | 34% | |

| Tax rebate | $ 9,520 | $ 9,520 | $ 9,520 | |

| Pv Factor @ 8.8 Lessor | 1 | 0.9452 | 0.8933 | 0.8444 |

| prasent Value | 84,000 | 8998.11 | 8504.83 | 8038.59 |

| PV of lease | 58458 | |||

| Pv [email protected] for lesse | 1 | 0.9191 | 0.8448 | 0.7765 |

| Lease per year | 19486 | 19486 | 19487 | |

So from above calculation we could say that lease payment equal to $ 58,458 equally well off

(b) In this example we have been provided that lessor has 34 % tax bracket and lesse is in nomtax brackate

so any lease above 19486 will be positive for lessor

Any cash flow that produce positive NPV will good for lesse i.e it may fall beetween 20,000 to 30,000 lease payment per year