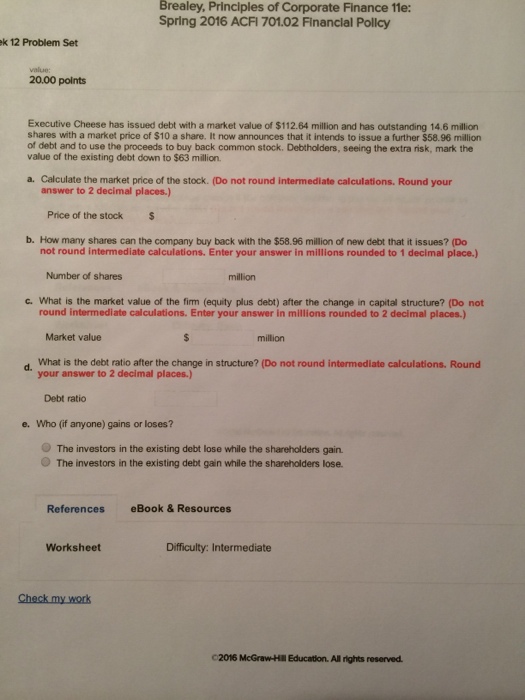

A.)

The market value of the firm’s equity increases by $49.64 million, the amount of the decrease in the market value of the firm’s existing debt.(112.64-63)

Therefore, the price of the stock increases to:($146 million + $49.64 million) / 14.6 million shares = $13.4

.Note that this is an outcome of the pure shift of one liability into another. In perfect capital markets(whereas there are no issues associated with taxes, bankruptcy, signaling of information) that is the ONLY effect

B)

Since the market price of the shares is $13.4, the company can buy back:$58.96 million / $13.4 = 4.4 million shares

c.)

After the change in capital structure, the market value of the firm is unchanged

Equity + Debt = (10.2 million x $13.4) + $121.96 million = $258.64 million

d.)

After the change in structure, the debt ratio is

:Debt / (Debt + Equity) = $121.96 million / $258.64million

= 0.47

e.)

The investors in the existing debt lose $49.64 million while the shareholders gain this$49.64 million. The value of each share increases by:$49.64 million / 14.6 million shares = $3.4.