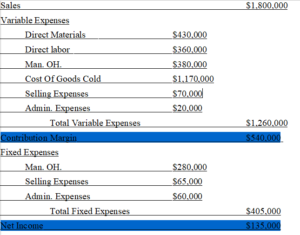

Jorge Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers, who charge customers 75 cents per bottle. For the year 2018, management estimates the following revenues and costs

| Sales | $1,800,000 | Selling expenses—variable | $70,000 |

| Direct materials | 430000 | Selling expenses—fixed | 65000 |

| Direct labor | 360000 | Administrative expenses—variable | 20000 |

| Manufacturing overhead—variable | 380000 | Administrative expenses—fixed | 60000 |

| Manufacturing overhead—fixed | 280000 |

Prepare a CVP income statement for 2018 based on management’s estimates.

Compute the break-even point in (1) units and (2) dollars.

Compute the contribution margin ratio and the margin of safety ratio.

Determine the sales dollars required to earn net income of $180,000

Answer:

1

2

Break-even point

= Fixed Costs/Contribution Margin

Total Units

= $1,800,000 in sales/$0.5 per unit

= 3,600,000 total units projected

Unit Contribution Margin

= $540,000/3,600,000 units

= $0.15

Break-even point

= $405,000/$0.15

= 2,700,000 units

Break-event point in $

= 2,700,000 x $0.5

= $1,350,000

3)

Contribution Margin Ratio

= (Sales –Variable Expenses)/Sales

= ($1,800,000 – $1,260,000)/$1,800,000

= 0.3 or 30%

Margin of Safety Ratio

= (Current Sales – Breakeven Point)/Current Sales

= (1,800,000 – $1,350,000)/(1,800,000)

= 0.25 or 20%

4)

Sales to achieve target net income

= (Fixed Costs + Target Income)/Contribution Margin Ratio

=($405,000 + $180,000)/0.3

= $1,950,000 in sales required to earn net income of $180,000