| Kohler Corporation reports the following components of stockholders’ equity on December 31, 2015: |

| Common stock—$20 par value, 100,000 shares authorized, 50,000 shares issued and outstanding | $ | 1,000,000 |

| Paid-in capital in excess of par value, common stock | 80,000 | |

| Retained earnings | 460,000 | |

| Total stockholders’ equity | $ | 1,540,000 |

| In year 2016, the following transactions affected its stockholders’ equity accounts. | |||

| Jan. | 1 | Purchased 5,500 shares of its own stock at $20 cash per share. | |

| Jan. | 5 | Directors declared a $4 per share cash dividend payable on Feb. 28 to the Feb. 5 stockholders of record. | |

| Feb. | 28 | Paid the dividend declared on January 5. | |

| July | 6 | Sold 2,063 of its treasury shares at $24 cash per share. | |

| Aug. | 22 | Sold 3,437 of its treasury shares at $17 cash per share. | |

| Sept. | 5 | Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. | |

| Oct. | 28 | Paid the dividend declared on September 5. | |

| Dec. | 31 | Closed the $428,000 credit balance (from net income) in the Income Summary account to Retained Earnings. | |

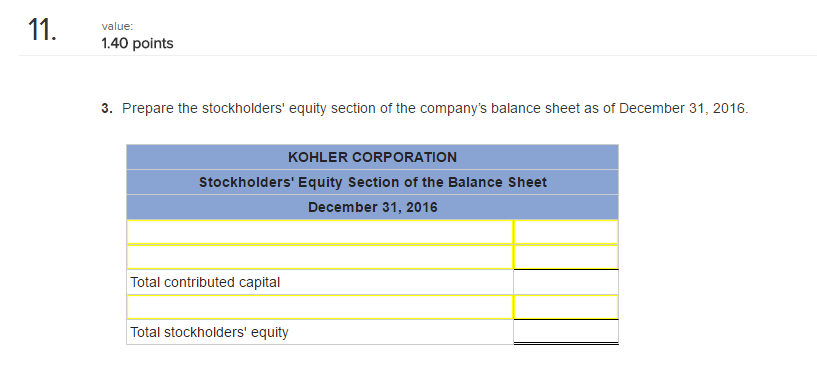

| KOHLER CORPORATION | |

| Stock holder equity section of balancesheet | |

| For Year Ended December 31, 2016 | |

| Common stock – $20 par value | 1,000,000 |

| Paid-in capital in excess of par value, common stock |

80,000 |

| Retained earnings | 507,941 |

| Total Shareholders Equity | 1,587,941 |

Working Notes:

Jan 01

DR Treasury stock, Common 110,000

CR Cash 110,000

Jan 05

DR Retained earnings 178,000

CR Common dividend payable 178,000

Feb 28

DR Common dividend payable 178,000

CR Cash 178,000

Jul 06

DR Cash 49513

CR Treasury stock, Common 41260

CR Paid-in capital, Treasury stock 8252

Aug 22

DR Cash 58429

DR Paid-in capital, Treasury stock 8252

DR Retained earnings 2059

CR Treasury stock, Common 68740

Sep 05

DR Retained earnings 200,000

CR Common dividend payable 200,000

Oct 28

DR Common dividend payable 200,000

CR Cash 200,000

Dec 31

DR Income summary 428,000

CR Retained earnings 428,000

Explanation:

Jan. 1 Purchased treasury stock (5500 × $20) = $110,000.

Jan. 5 Declared $4 dividend on 44500 outstanding shares = $ 178,000

July 6 Cash = (2063 × $24) = $49512.

Treasury Stock, Common = (2063 × $20) = $30,000.

Paid-In Capital, Treasury Stock = (2063 × $4) = $6,000.

Aug. 22 Cash = (3437 × $17) = $ 58429

Treasury Stock, Common = (2,500 × $20) = $68740.

Sept. 5 Declared $4 dividend on 50,000 outstanding shares = $200,000

Explanation:

Common stock ($20 par value, 100,000 shares authorized, 50,000 shares issued and outstanding) = $ 1,000,000