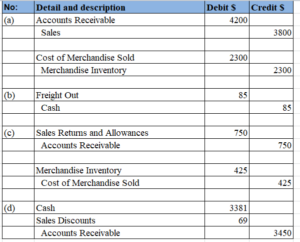

Merchandise with a list price of $4,200 and costing $2,300 is sold on account, subject to the following terms: FOB destination, 2/10, n/30. The seller prepays the freight costs of $85 (debit Freight Out for the freight costs). Prior to payment for the goods, the seller issues a credit memo for $750 to the customer for merchandise costing $425 that is returned. The correct amount is received within the discount period. The company uses a perpetual inventory system

Record the foregoing transactions of the seller in the sequence indicated below.

| (a) | Sold the merchandise, recognizing the sale and cost of merchandise sold. |

| (b) | Paid the freight charges. |

| (c) | Issued the credit memo. |

| (d) | Received payment from the customer. |

Darshita Changed status to publish February 17, 2020