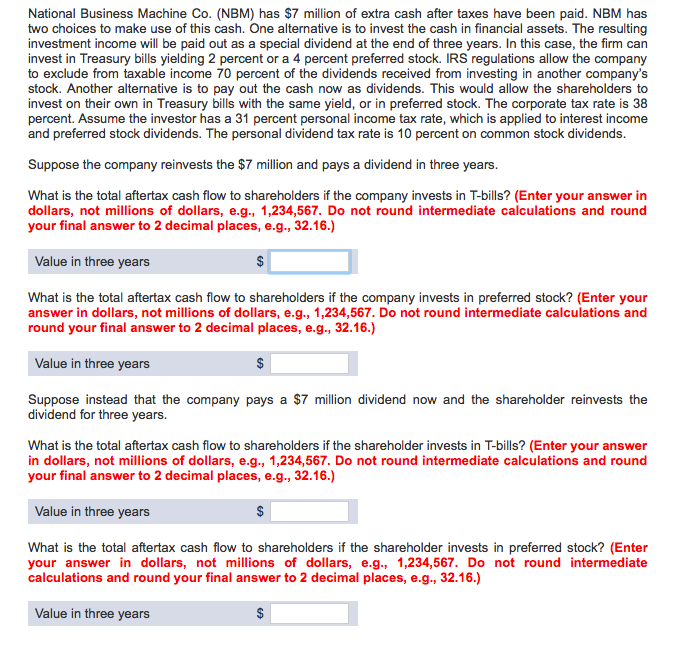

Since $ 7,000,000 is after tax ,The full amount is invested ,

So the value of each alternative is

Alternative 1

The firm invest in T-bill or in preferred stock and then pays out as special Dividend in 3 year

If the firm invest in T-bill

If the firm invest in T-bill, The after tax yield on T bill

After Tax corporate yield = 0.02(1- 0.38)

=0.0124

=1.24%

So the future value of corporate investment in Tbill will be

FV = 7,000,000 (1+0.124)3

=7,000,000*1.03766

=7263642

Since the future value is paid as dividend to share holder ,The after tax cash flow will be

=7263642 * (1-0.10)

=$6,537,278

If the firm invest in preferred stock ,the assumption would be that the dividend received will be invested in the same preferred stock, the preferred stock will be pay dividend of

Proffered Dividend = 0.04(7,000,000)

=2,800,000

Since 70% of dividend are exclude from tax

Taxable preferred Dividend

= (1-0.70) *($ 2800000)

=$ 84,000

Taxable preferred Dividend = $ 84000 and the taxes company must pay on the preferred dividend will be

taxes On preferred Dividend =

=0.38 (840000)

taxes On preferred Dividend =

31920

So the after tax dividend for the corporation will be

=280000- 31920

=$248,080

This means after tax corporate dividend Yield is

after tax corporate dividend Yield is= 248080 / 7000000

=0.03544

=3.54%

The future value of company investment in preferred stock will be

future value of company investment in preferred stock= (7,000,000) * (1.0354)3

=7000,000 *1.1101

=7770927.452

Since the future value is paid as dividend to share holder ,The after tax cash flow will be

=7770927.452 * (1-0.10)

=$6,993,834.71