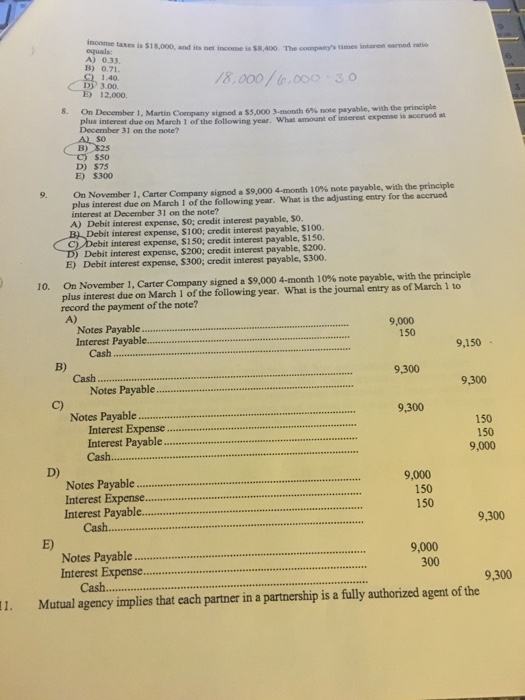

8)

9 Total interest of note = [ $ 5,000 x 0.06 x (90/360) ] = $ 75

(1/3) of that amount is accrued on Dec. 31 since the note was signed on Dec. 1

B. $ 25

9)

Debit interest expense, $150; credit interest payable, $150.

Calculated as under

$9,000 X 10% / 360 X 60

=150

So the anwer is

=Debit interest expense, $150; credit interest payable, $150.

10)

Based on the statement above , s the amount the company will pay for the note at maturity is as under

$9,300

Calculated as under

$9,000 + ($9,000 X 10% / 360 X 120)

=9300

B) notes payable 9000

Interest EXp 300

To cash 9300