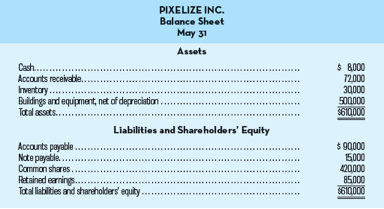

The balance sheet of Pixelize Inc., a photographic supplies distributor, as of May 31 is given below:

Pixelize Inc. has not budgeted previously, so it is limiting its master budget planning horizon to just one month ahead—namely, June. The company has assembled the following budget data relating to June:

Sales are forecast to be $250,000; $60,000 will be received in cash; the balance will be credit sales. One-half of the credit sales for a month are collected in the month of sale, and the balance is collected the next month. The entire May 31 accounts receivable balance will be collected in June.

Inventory purchases are expected to total $200,000 during the month of June. All of these purchases will be on account. Forty percent of all inventory purchases is paid for in the month of purchase with the other 60% paid the next month. The entire balance of the May 31 accounts payable to suppliers will be paid during June.

The inventory balance for June 30 is budgeted at $40,000.

The selling and administrative expenses budget for June is $51,000, excluding depreciation. All of these expenses will be paid in cash. The depreciation budget is $2,000 for the month.

The May 31 note payable that appears on the balance sheet will be paid in June. Interest expense for the month of June (all borrowings) will be $160, to be paid in cash.

Warehouse equipment totalling $9,000 will be acquired for cash in June.

In June, the company will borrow $18,000 from the bank by issuing a new note payable to the bank for that same amount. The new note will be due in one year.

Required:

Prepare a cash budget for June. Support your budget with a schedule of expected cash collections from sales and a schedule of expected cash disbursements for inventory purchases.

Prepare a budgeted income statement for June. Use the absorption costing income statement format as shown in example (A) below.

Prepare a budgeted balance sheet as of June 30.

| Schedule of cash payments for purchases: | |

| Partivcular | Amount in $ |

| May 31 accounts payable balance | 90000 |

| June purchases (40% × 200,000) | 80000 |

| Total cash payments | 170000 |

| Pixelize, Inc.Cash Budget For the Month of June | |

| Partivcular | Amount in $ |

| Cash balance, beginning | 8000 |

| Add receipts from customers (above) | 227000 |

| Total cash available | 235000 |

| Less disbursements: | |

| Purchase of inventory (above) | 170000 |

| Selling and administrative expenses | 51000 |

| Purchases of equipment | 9000 |

| Total cash disbursements | 230000 |

| Excess of receipts over disbursements | 5000 |

| Financing | |

| Borrowings | 18000 |

| Repayments | -15000 |

| Interest | -500 |

| Total financing | 2500 |

| Cash balance, ending | 7500 |

| Pixelize, Inc. Budgeted Income Statement For the Month of June | ||

| Partivcular | Amount in $ | Amount in $ |

| Sales | 250000 | |

| Cost of goods sold: | ||

| Beginning inventory | 30000 | |

| Add purchases | 200000 | |

| Goods available for sale | 230000 | |

| Ending inventory | 40000 | |

| Cost of goods sold | 190000 | |

| Gross margin | 60000 | |

| Selling and administrative expenses (51000+2000) |

53000 | |

| Operating income | 7000 | |

| Interest expense | 500 | |

| Net income | 6500 | |

| Pixelize, Inc. Budgeted Balance Sheet June 30 | |

| Partivcular | Amount in $ |

| Assets | |

| Cash | 7500 |

| Accounts receivable (50% × 190,000) | 95000 |

| Inventory | 40000 |

| Buildings and equipment, net of depreciation ($500,000 + $9,000 – $2,000) |

507000 |

| Total assets | 649500 |

| Liabelity | |

| Accounts payable (60% × 200,000) | 120000 |

| Note payable | 18000 |

| Common stock | 420000 |

| Retained earnings ($85,000 + $6,500) | 91500 |

| Total liabilities and equity | 649500 |