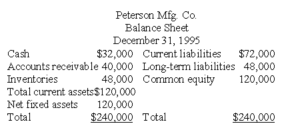

The balance sheet for Peterson Manufacturing Company is presented below.

During 2009,the firm earned $28,000 after taxes based on net sales of $480,000. a.Calculate Peterson’s current ratio and net working capital. b.Assume that Peterson’s uses $20,000 of its cash to reduce current liabilities.Recompute the current ratio and net working capital. c.What effect,if any,does the change proposed in question b have on Peterson’s liquidity.

Darshita Changed status to publish August 7, 2020

Answer:

A)

Current ratio

= ($120,000)/($72,000)

= 1.67

Net working capital

= $120,000 – $72,000

= $48,000

b.

Current ratio

= ($100,000)/($52,000)

= 1.92

Net working capital

= $100,000 – $52,000

= $48,000

c. Yes, company’s liquidity position with measuring current ratio improves slightly but net working capital is lower. The composition of Peterson’s current assets is less liquid than before because cash is the most liquid asset.

Darshita Changed status to publish August 7, 2020