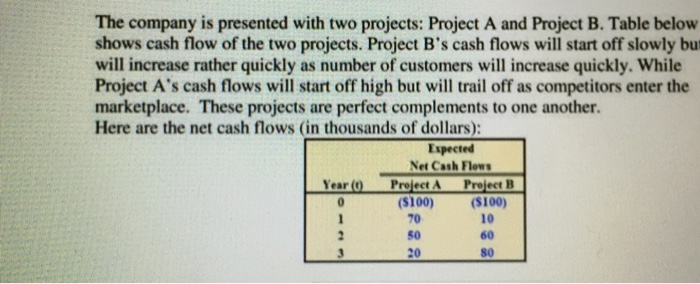

Here we do not have provided with the tax struture of the company so for finding out the WACC we will find out the IRR of the both the project as follow

Project A

IRR

0 = -100 + 70(1+r)1 +50(1+r)2 +20(1+r)3

Solving this equation by trial and error method we will get

WACC of the project A =23.5641

=23.56%

Project B

IRR

0 = -100 + 10(1+r)1 +60(1+r)2 +80(1+r)3

Solving this equation by trial and error method we will get

WACC of the project B =18.1258%

=18.13%