The following transactions apply to Bobs Scuba Sales for 2018:

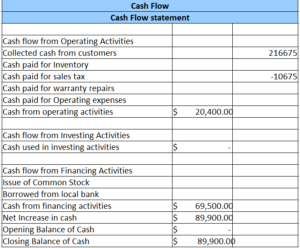

The business was started when the company received $48,500 from the issue of common stock.

Purchased equipment inventory of $176,000 on the account.

Sold equipment for $202,500 cash (not including sales tax). A sales tax of 7 percent is collected when the merchandise is sold. The merchandise had a cost of $127,500.

Provided a six-month warranty on the equipment sold. Based on industry estimates, the warranty claims would amount to 4 percent of sales.

Paid the sales tax to the state agency on $152,500 of the sales.

On September 1, 2018, borrowed $21,500 from the local bank. The note had a 7 percent interest rate and matured on March 1, 2019.

Paid $5,900 for warranty repairs during the year.

Paid operating expenses of $55,500 for the year.

Paid $124,200 of accounts payable.

Recorded accrued interest on the note issued in transaction no. 6

Prepare the Statement of Cash Flows For the Year Ended December 31, 2018