Using the loanable funds theory, show in a graph how the following events will affect the supply and demand for loans and the equilibrium nominal interest rate:

a. Recent signs of economic growth cause an increase in the public’s expectations of future inflation.

b. Consumer and investor confidence grows.

eaning of Lonable fund and theory :

Lonable funds means total of all the money i.e available in all form credit,loans ,bond,deposit and cash that people and entities in an economy has decided to save and lend out to borrowers as an investment rather than use for personal consumption.Financial assets or money that is available to borrow.

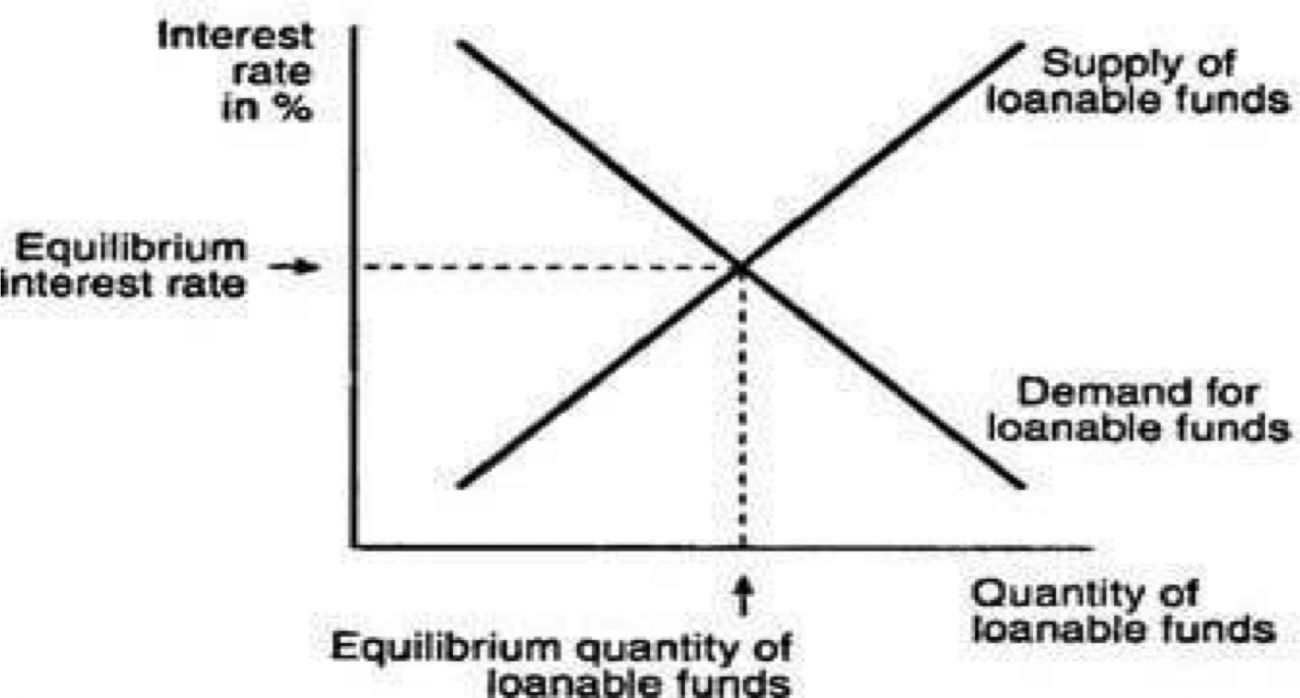

Lonable funds theory means it uses the analysis the suuply of funds ,demands of funds and interest rates for loans in the economy In other words lonable fund theory is theory of intrerest rate.interest rate is determined by the demand for lonable funds in the market and supply of loanable funds.

Suppose the market for loanable funds is in equilibrium,the interest rate would decrease and the quantity of loanable funds would increase

Most important factor for the interest rate over the time is changing expactation about inflation rate

Generally it decreases the demand for loanable funds, thereby increasing the nominal interest rate

in this graph we see that in inflation period the demand for the lonable fund decrese and increasing the nominal interest rate

in this graph we see that in inflation period the demand for the lonable fund decrese and increasing the nominal interest rate

when

b. Consumer and investor confidence grows. the demand of lonable fund increses and real interest rate would decrese

decreses  in this graph we can see that when Consumer and investor confidence grows.the demand of lonable fund increses and interset rate is decreasing

in this graph we can see that when Consumer and investor confidence grows.the demand of lonable fund increses and interset rate is decreasing